How Does an Insurer Decide if a Car is Totaled?

Let’s say you have full coverage on an older vehicle. Due to depreciation, the vehicle is worth about $5,000. On a snowy day, you lose traction and slide into a post at low speed. The damage doesn’t look that bad but a repair estimate comes in at $4,000 because the car took the hit on the corner, damaging both the front and side. The insurer totals the car, even though there is a $1,000 difference between the cost of the repair and the car’s value. But why?

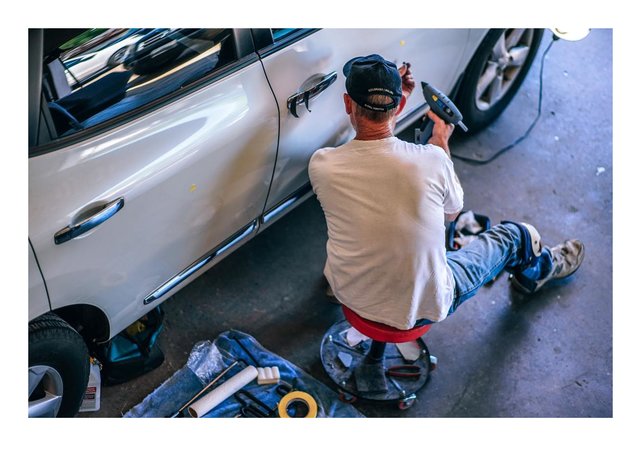

Insurance rules may vary by province or by insurer, but if the value of the car and the repair cost are close, expect the vehicle to be totaled because surprise costs can come up after the repair shop starts taking things apart. Chances are good that they’ll find a broken whatsit and a bent whoosamajigger and maybe even a cracked whatchamacallit that were all hidden from view during the initial estimate. Once you add the cost of replacing these items and the account for labor, the value of the vehicle can easily be exceeded by the repair cost.

If your car is totaled in an accident and you are at fault, your insurer pays the actual cash value of the car minus your deductible for a covered claim. If you had a $1,000 deductible in the example above, the insurer would pay $4,000 for your car with a value of $5,000. However, you’d have to surrender the car and sign over the title to the insurer.

For an older car, this may not be much of an issue. For a newer car, however, you may still have a loan balance and in the early part of the loan, it’s possible that you owe more than the car is worth. If that’s the case, you’ll still owe the balance that wasn’t covered by your insurance. A separate product called GAP insurance is designed to address these situations and pay off your loan balance if your car is totaled.

The other consideration with newer cars, in particular, is the deductible amount. If you chose a high deductible, the insurer pays less for the vehicle in a total loss, possibly leaving a bigger gap between the insurance payout and the amount owed for the car. The deductible is the part of the claim that you pay and is deducted from your claim payout. If you’re not sure how much your deductible is, reach out to your broker. It may be time for a full policy review to be sure your policy is structured in the right way to protect you.